Making the most of my time: Multitasking while patiently waiting in line to claim my hard-earned Savings

In this article, I will share with you my personal experience and insights on how I successfully claimed my Pag-IBIG MP2 savings after its 5-year maturity. I’ll provide you with practical tips and guidance to help make your own claiming journey as smooth and efficient as possible.

Here’s how it all went down:

Step 1: Show Up Early and Wait for Your Turn

I made it to the branch at 7:30 a.m. and there was already a line forming, but luckily, the friendly security guards let us in quickly. I had three important tasks on my list: I needed to change my last name to my married one, upgrade my PAG-IBIG Loyalty Card to a Loyalty Plus card, and claim my MP2 Savings.

Step 2: The Waiting Game

I was the 11th person in line for the MEMBERSHIP/Loyalty Card PLUS Application. After completing the Loyalty Card PLUS Application, I headed over to the MP2 Maturity Claims counter. The counter for MP2 Maturity Claims opens at 8:00 a.m. Luckily, I was the only one in line for the providence claims.

FYI, I was able to get my Pag-IBIG Loyalty Card Plus on the same day. I paid a PhP 125.00 loyalty card fee.

Step 3: Gather Your Papers

Before you go, make sure you’ve got your documents ready:

- APPLICATION FOR PROVIDENT BENEFITS (APB) CLAIM (fill it out before you go).

- Two valid IDs (I took my passport and Loyalty Plus Card, but you might only need one).

- Photocopies of your IDs with three signatures on the side.

Step 4: Hand in Your Stuff

I handed over my documents, and once the staff checked to make sure all the information was correct, they gave me a slip with my claim details. Then, all that was left to do was wait for a text message.

Step 5: Follow-Up and Notification

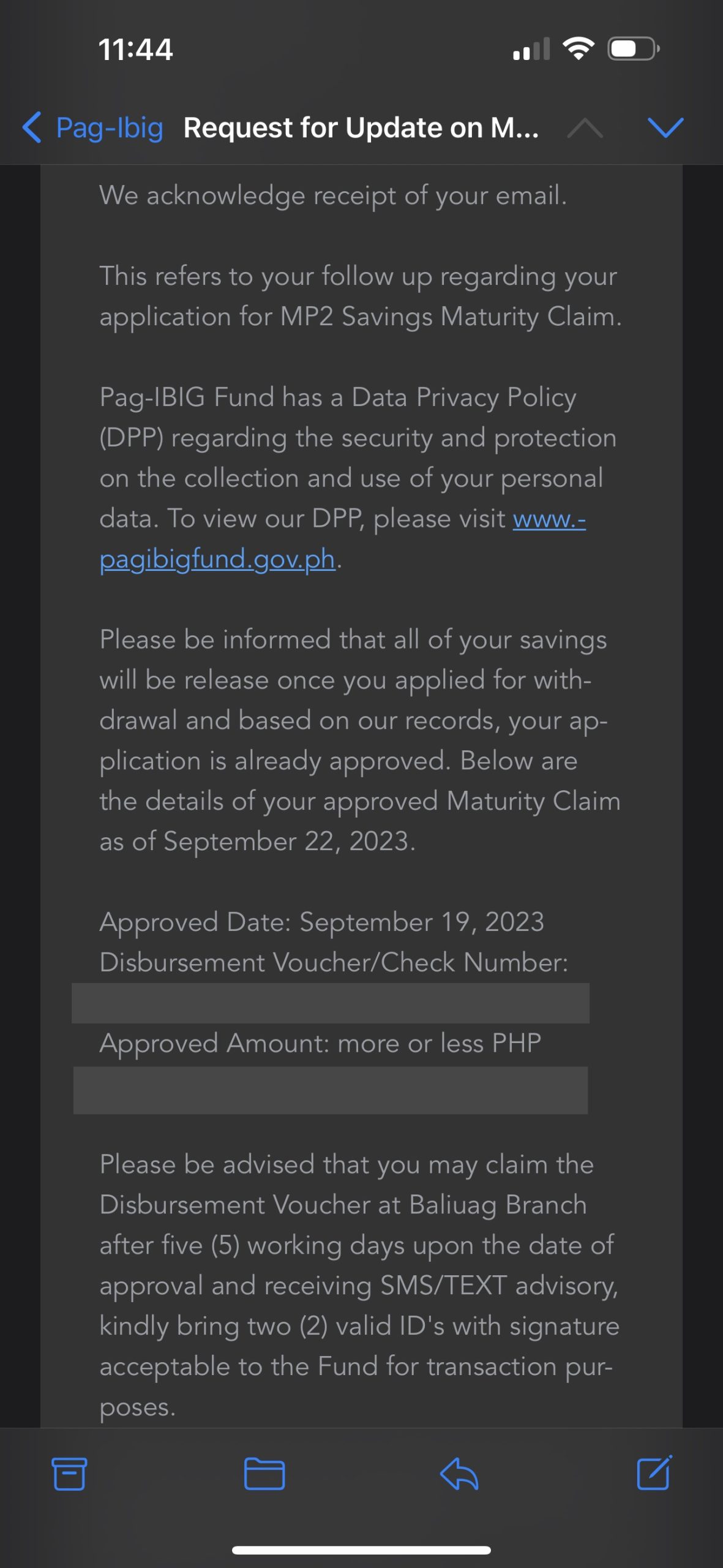

Feeling impatient, I decided to email PAG-IBIG for an update on my MP2 Maturity Claim Status on September 21, 2023. The following day, I received a prompt response from PAG-IBIG.

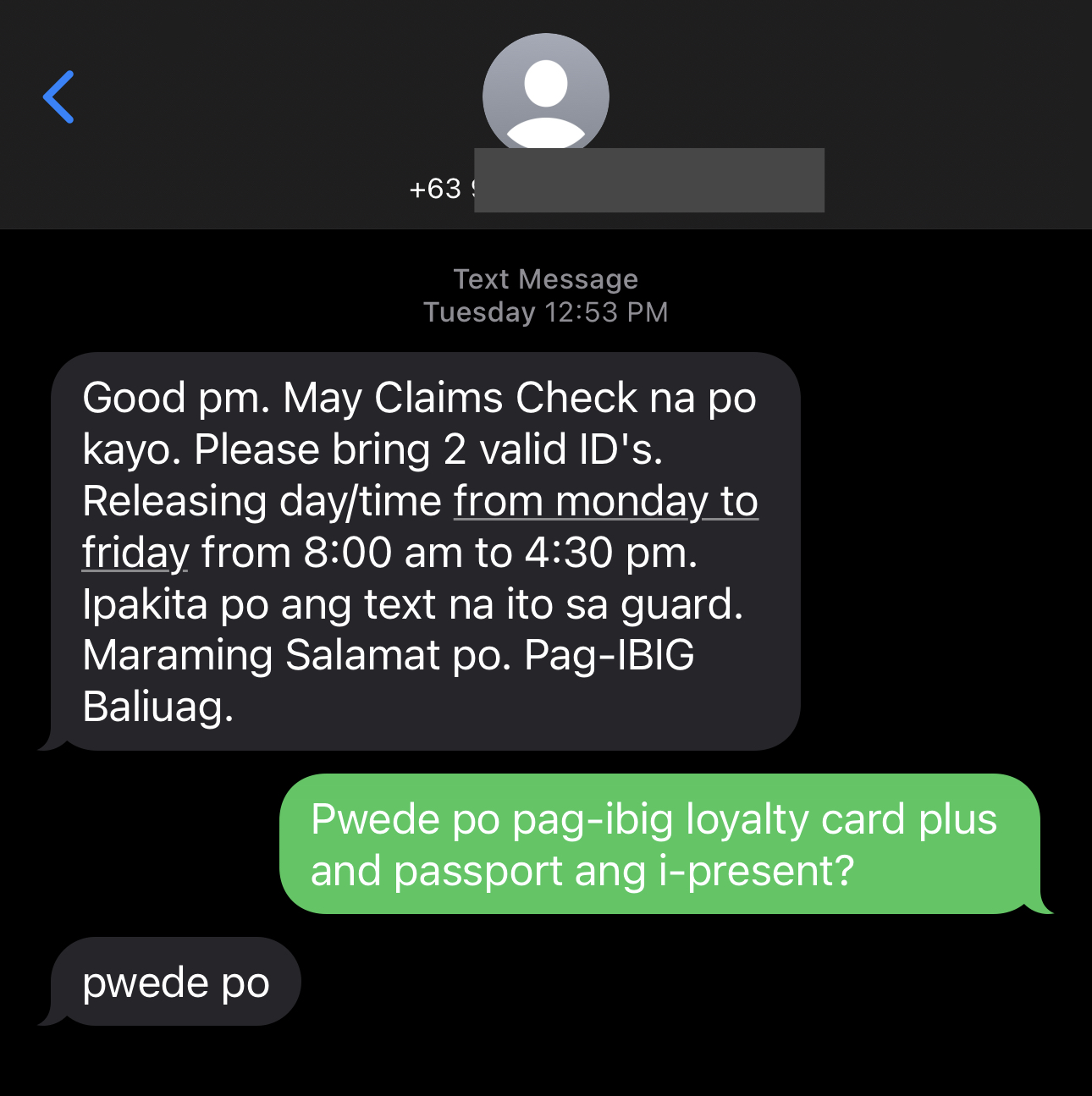

Step 6: Grab Your Cheque

On September 26, 2023, PAG-IBIG sent me a text message, informing me that I could pick up my cheque. So, on September 27, 2023, around 11:00 a.m., I headed to the branch with my two valid IDs (passport and my Loyalty Plus card). Additionally, I brought along the slip they had given me earlier. The great news was that there was no line, making the process quick and hassle-free.

Step 7: Cash That Cheque

To cash your cheque, you must take it to a Land Bank of the Philippines (LBP) branch, bring your ID, and pay a 200 peso fee.

Optional: Claim Online

You can also get your MP2 Savings online through the Virtual Pag-Ibig website. Here’s the link: https://www.pagibigfundservices.com/virtualpagibig/ClaimSavings.aspx.

Once you decide to withdraw your Pag-IBIG MP2 savings after the 5-year maturity period, you will receive the entire amount accumulated in your account. At first, I wanted to take out only a part of what I saved, about one-third. But when I tried, I found out that they give you everything you saved, not just a bit. This surprised me because I thought I could take out only what I needed. It’s something important to know because it might change your plans for how you want to use your money.

That’s a wrap! From applying to encashing my cheque, it took just 8 days. Quick and hassle-free!

To learn more about Pag-IBIG MP2 Savings Programs, feel free to check out my other article here: A Guide to MP2 Savings. This article provides valuable insights into understanding and maximizing the benefits of the Pag-IBIG MP2 savings program.